Every significant decision, whether for a sprawling enterprise or a personal investment, boils down to a fundamental question: is it worth it? Understanding the true value of any pricing structure, plan, or project requires more than just glancing at a sticker price. It demands a rigorous Pricing, Plans & Cost-Benefit Breakdown, a systematic approach that illuminates whether the potential upsides truly outweigh the downsides. This isn't just about crunching numbers; it's about making smarter, more informed choices that steer you towards success and away from costly missteps.

At a Glance: Your Guide to Smarter Decisions

- Cost-Benefit Analysis (CBA) is your ultimate tool for evaluating projects, decisions, and investments.

- It systematically compares all associated costs (direct, indirect, opportunity, intangible, risks) with all potential benefits (direct, indirect, intangible).

- The goal? To clearly see if benefits outweigh costs, revealing true value and viability.

- Key metrics like Net Present Value (NPV) and CBA Ratio help quantify profitability and efficiency.

- CBA is crucial for everything from new product launches and policy changes to major equipment purchases.

- Don't forget to account for intangibles like brand reputation or employee morale—they hold real value.

- Templates and structured steps can streamline your analysis, making it repeatable and reliable.

Unpacking the Power of Cost-Benefit Analysis

At its heart, Cost-Benefit Analysis (CBA) is a common-sense idea, formalized: measure what you put in versus what you get out. It's a structured method for dissecting the financial implications of any proposed project or decision. By lining up all the expenses against all the gains, you gain an objective lens to determine if a venture is truly worthwhile, feasible, and value-generating. Think of it as your financial compass, guiding you through complex choices with data, not just gut feeling.

The Anatomy of a Decision: What Are You Really Weighing?

To conduct a meaningful CBA, you first need to understand the full spectrum of what you're evaluating. It's rarely as simple as money in, money out. There are often hidden costs and subtle benefits that, if overlooked, can drastically skew your perception of value.

Decoding the "Costs" Side of the Ledger

When you commit to a plan or a project, you're not just incurring the obvious expenses. A thorough CBA considers:

- Direct Costs: These are the straightforward, easily quantifiable expenses directly tied to the project. Imagine the raw materials for a new product, the wages for the team building it, or the price tag on new machinery. They're often the first things that come to mind.

- Indirect Costs: The less obvious, but equally real, overhead expenses. Think about the portion of your office rent, utility bills, or general administrative salaries that indirectly support the project. These aren't tied to a specific output but are essential for operations.

- Opportunity Costs: This is a critical, yet often forgotten, category. It's the value of the next best alternative you didn't pursue by choosing this particular project. For example, if you invest capital in new software, the opportunity cost might be the profit you could have made by investing that same capital in a different marketing campaign.

- Intangible Costs: These are non-monetary costs that are challenging to quantify but have a profound impact. A new policy might lead to decreased employee morale, or a rushed product launch could damage customer satisfaction. While hard to put a number on, their long-term effects can be substantial.

- Risks: Every project carries uncertainties. These are potential costs that materialize if things go wrong—think schedule delays that incur penalties, unexpected technical glitches, or regulatory fines. A robust CBA anticipates these potential pitfalls.

Unveiling the "Benefits" Side of the Ledger

Just as costs extend beyond the immediate, benefits aren't always just about direct revenue. A comprehensive view includes:

- Direct Benefits: The immediate, positive financial outcomes. This could be increased revenue from a new product, significant cost savings from an optimized process, or improved efficiency leading to higher output. These are usually the primary drivers for a project.

- Indirect Benefits: Secondary positive effects that might not directly hit the balance sheet but contribute to overall organizational health. An example could be improved brand reputation due from a socially responsible initiative, or increased productivity stemming from better workplace conditions.

- Intangible Benefits: Non-monetary advantages that are difficult to assign a dollar value but are incredibly valuable. Enhanced customer satisfaction, improved employee well-being, a stronger company culture, or the positive ripple effect of a community engagement program all fall into this category. Like intangible costs, they require careful consideration and estimation.

Why You Can't Afford to Skip This Step: The Power of CBA

Choosing to ignore a thorough cost-benefit analysis is like sailing without a map. You might get somewhere, but you're leaving success to chance. Embracing CBA offers distinct advantages:

- Informed Decision-Making: Forget gut feelings or biased opinions. CBA provides a data-driven framework that enables objective choices, ensuring decisions are rooted in facts, not assumptions.

- Risk Mitigation: By systematically identifying potential costs, including risks, you're better equipped to anticipate and develop strategies to mitigate them before they derail your project.

- Enhanced Understanding of Project Goals: The act of breaking down costs and benefits forces you to clarify your objectives and expected outcomes, leading to better stakeholder alignment and a shared vision.

- Resource Allocation Optimization: With a clear picture of potential return on investment (ROI) for various initiatives, you can prioritize resources—time, money, and talent—where they'll yield the greatest impact.

- Long-Term Perspective: CBA encourages you to look beyond immediate gains or losses, promoting a comprehensive view of decision outcomes that supports sustainable practices and long-term growth.

When to Deploy Your CBA Superpower

Cost-Benefit Analysis isn't just for multi-million dollar corporate ventures. It's a versatile tool applicable across a spectrum of scenarios:

- Launching a New Project: Should you greenlight that innovative product idea? CBA helps you quantify its potential.

- Developing New Business Processes or Strategies: Is that new workflow truly more efficient, or will it create more headaches?

- Comparing Investment Opportunities: Faced with multiple paths forward, which one promises the best return? CBA provides an apples-to-apples comparison.

- Considering Major Purchases: Whether it's a new fleet of vehicles or an enterprise software solution, weigh the total cost of ownership against the projected benefits.

- Evaluating Policy Changes: For governments or large organizations, CBA helps forecast the broader economic and social impacts of new regulations or internal policies.

- Personal Decisions: Even for individual choices, like deciding whether to go back to school or make a significant home renovation, a simplified CBA can provide clarity on your options and help you Uncover ClassPasss true value of a subscription service, for example.

Your Step-by-Step Guide to a Flawless CBA

Ready to put CBA into practice? This systematic, 6-step framework will guide you through the process, ensuring no stone is left unturned.

1. Define Your Mission: Scope & Objectives

Before you analyze anything, you need to know exactly what you're analyzing. Clearly outline the project's objectives, its defined timeline, the expected outcomes, and the metrics you'll use to measure success. A well-defined scope prevents "scope creep" and ensures your analysis stays focused on the relevant variables.

- Example: For a new software implementation, define what business problems it solves, who it affects, the launch date, and how you'll measure user adoption and productivity gains.

2. The Great Inventory: Listing Costs and Benefits

This is where you gather data. Dive into historical records, consult industry benchmarks, and interview stakeholders. Brainstorm and list every single potential cost and benefit you can think of. Don't self-censor here; cast a wide net initially.

Categorize each item: Is it a direct cost or benefit? Indirect? An opportunity cost? An intangible? Or a specific risk? Consider both the immediate, short-term impacts and the long-term ripple effects over the project's lifecycle.

3. Putting a Price Tag on Everything: Monetization

Here's where the rubber meets the road. Assign a monetary value to every cost and benefit you've identified. Direct costs are usually straightforward. For benefits like increased revenue or cost savings, calculate the projected financial impact.

Intangible factors require a bit more finesse. This might involve:

- Estimation Techniques: Using historical data from similar projects, even if they weren't identical.

- Proxy Measures: Finding a measurable substitute. For instance, reduced employee turnover (an intangible benefit) could be valued by the cost saved in recruiting and training replacements.

- Expert Judgment: Consulting subject matter experts to get their informed estimates.

- Surveys: Asking customers or employees about their "willingness to pay" for a particular benefit or how they value certain improvements.

Crucially, document all your assumptions and the methods used to assign these values. Transparency is key to credibility.

4. The Math That Matters: NPV, PV, and CBA Ratio

Money today is worth more than money tomorrow. This fundamental principle of finance is handled through discounting, which converts future costs and benefits into their Present Value (PV). You'll need an appropriate discount rate (which reflects the risk and opportunity cost of capital) to do this.

- Present Value (PV) = Future Value (FV) / (1 + r)^n

- Where FV = Future Value, r = Discount Rate, n = Number of periods (e.g., years)

Once you have the present value of all costs and all benefits: - Net Present Value (NPV) = PV of Benefits - PV of Costs

- CBA Ratio = PV of Benefits / PV of Costs

The Verdict: - A positive NPV means the project is expected to generate more value than it costs.

- A CBA ratio greater than 1 indicates that the benefits outweigh the costs.

- Both suggest financial viability. If NPV is negative or the ratio is less than 1, the project is likely not financially sound as proposed.

5. What If? Stress-Testing Your Assumptions (Sensitivity Analysis)

Your CBA relies on numerous assumptions about future costs, benefits, and the discount rate. What if those assumptions are slightly off? Sensitivity analysis helps you examine how changes in these key variables affect your results.

By tweaking your most uncertain figures (e.g., estimated sales, project completion time, or interest rates), you can evaluate the robustness of your analysis. This identifies the factors with the most significant impact on your outcome, allowing you to focus your risk management efforts. A project that remains viable even under less optimistic scenarios is a strong candidate.

6. The Verdict: Recommendation & Prioritization

Finally, synthesize your findings. Present the results of your calculations, including NPV and CBA ratio, clearly and concisely. Crucially, don't just present numbers; offer a recommendation. Should the project proceed? Be transparent about any limitations in your analysis, the risks identified, and any uncertainties that remain.

If you're evaluating multiple projects, your CBA results provide a powerful tool for prioritization, helping you allocate resources to initiatives that offer the highest potential return.

A Real-World Scenario: Purchasing New Manufacturing Equipment

Let's walk through a concise example to see CBA in action.

- Project: A mid-sized factory is considering purchasing new manufacturing equipment.

- Inputs:

- Initial Equipment Cost: $500,000 (a direct cost)

- Useful Life of Equipment: 5 years

- Annual Maintenance Cost: $20,000 (an indirect, recurring cost)

- Annual Production Increase: 10,000 units (a direct benefit driver)

- Selling Price per Unit: $50

- Variable Cost per Unit (materials, labor): $30

- Discount Rate: 10% (reflects the company's cost of capital and risk)

- Calculations (Simplified for illustration):

- Annual Net Profit (Benefit) from increased production:

- (10,000 units * ($50 Selling Price - $30 Variable Cost)) - $20,000 Annual Maintenance = $180,000

- Total Present Value (PV) of Benefits (over 5 years):

- Using the 10% discount rate, the PV of $180,000 annually for 5 years = approximately $680,670

- Total Present Value (PV) of Costs:

- Initial Cost: $500,000

- PV of Annual Maintenance ($20,000 annually for 5 years at 10% discount) = approximately $75,745

- Total PV of Costs = $500,000 + $75,745 = $575,745

- Net Present Value (NPV):

- PV of Benefits - PV of Costs = $680,670 - $575,745 = $104,925

- CBA Ratio:

- PV of Benefits / PV of Costs = $680,670 / $575,745 = 1.18

- Conclusion:

The positive NPV of $104,925 and a CBA ratio of 1.18 (which is greater than 1) strongly suggest that purchasing the new manufacturing equipment is a financially viable and attractive investment. The benefits are projected to significantly outweigh the costs over the equipment's useful life.

Navigating the Tricky Waters: Challenges & Intangibles

While CBA is a powerful tool, it's not without its complexities. Acknowledging these challenges is part of conducting a robust analysis.

Common Hurdles in Cost-Benefit Analysis

- Accurately Estimating Future Costs and Benefits: The future is uncertain. Projecting market demand, inflation rates, or unforeseen technical issues can be challenging.

- Assigning Monetary Values to Intangible Factors: This is often the trickiest part. How do you quantify improved public image or reduced employee stress?

- Choosing an Appropriate Discount Rate: The discount rate significantly impacts PV, NPV, and the CBA ratio. Selecting a rate that accurately reflects the project's risk and the organization's cost of capital is crucial.

- Accounting for Uncertainties and Risks: While sensitivity analysis helps, some risks are simply hard to predict or quantify accurately.

Incorporating Intangibles: Making the Invisible Visible

Don't let the difficulty of valuing intangibles lead you to ignore them. Their impact can be profound. Here's how to approach them:

- Proxy Measures: As mentioned earlier, find a measurable substitute. For instance, the benefit of "improved customer satisfaction" could be proxied by reduced customer churn rates, decreased customer support calls, or an increase in repeat business, all of which have quantifiable financial impacts.

- Surveys and Expert Judgment: Conduct surveys to gauge stakeholder perceptions or willingness to pay for certain attributes. Tap into the knowledge of seasoned experts who can provide informed estimates based on their experience.

- "Willingness to Pay" Studies: For public goods or services (e.g., environmental improvements), economists sometimes use methods to estimate how much people would be willing to pay for a non-market benefit.

- Document Assumptions: No matter the method, clearly document how you arrived at your monetary values for intangibles. State your assumptions, the data sources, and the rationale behind your estimations. This transparency adds credibility and allows others to understand the basis of your calculations.

CBA vs. Its Cousins: Cost-Effectiveness Analysis (CEA)

It's easy to confuse Cost-Benefit Analysis with other similar frameworks. Understanding the distinctions is key to choosing the right tool for the job.

Cost-Benefit Analysis (CBA) is all about comparing total costs to total benefits, with both expressed in monetary terms. Its primary goal is to determine if the benefits financially outweigh the costs, giving you a clear indicator of overall financial viability and return. "Is this project financially sound?" is the question CBA answers.

Cost-Effectiveness Analysis (CEA), on the other hand, takes a different approach. It compares the relative costs of different ways to achieve a specific, pre-defined outcome. The key here is that while costs are measured in monetary terms, the benefits are often difficult or impossible to monetize directly. Instead, they are measured in non-monetary units relevant to the desired outcome.

- Example: In healthcare, you might use CEA to compare different treatment options for a disease. The outcome (e.g., "life-years saved" or "reduction in symptoms") isn't easily monetized, but you can compare the cost of Treatment A versus Treatment B to achieve that specific health outcome. "Which option achieves our goal most efficiently?" is the question CEA answers.

Choose CBA when you need to know if a project is financially viable and can monetize most of its benefits. Choose CEA when you have a specific, non-monetizable goal and need to find the most cost-efficient way to achieve it.

Streamlining Your Process: Why Use CBA Templates?

Conducting a thorough CBA can be complex, especially for large projects. This is where Cost-Benefit Analysis templates become invaluable. These structured frameworks provide a repeatable, consistent approach to evaluating potential investments.

The Undeniable Benefits of a CBA Template

- Supports Data-Driven Decisions: Templates ensure you systematically capture all relevant data, guiding you toward objective, evidence-based choices rather than subjective ones.

- Standardizes Calculations Across a Project Portfolio: If your organization evaluates multiple projects, a template ensures consistency in how costs and benefits are identified, valued, and analyzed. This allows for easier comparison and prioritization.

- Improves Risk Management: Templates often include dedicated sections for identifying and quantifying risks, prompting a proactive approach to potential problems.

- Reduces Analysis Time: You don't have to start from scratch every time. A pre-built structure saves time, allowing you to focus on data gathering and analysis rather than framework design.

What Makes a Good CBA Template?

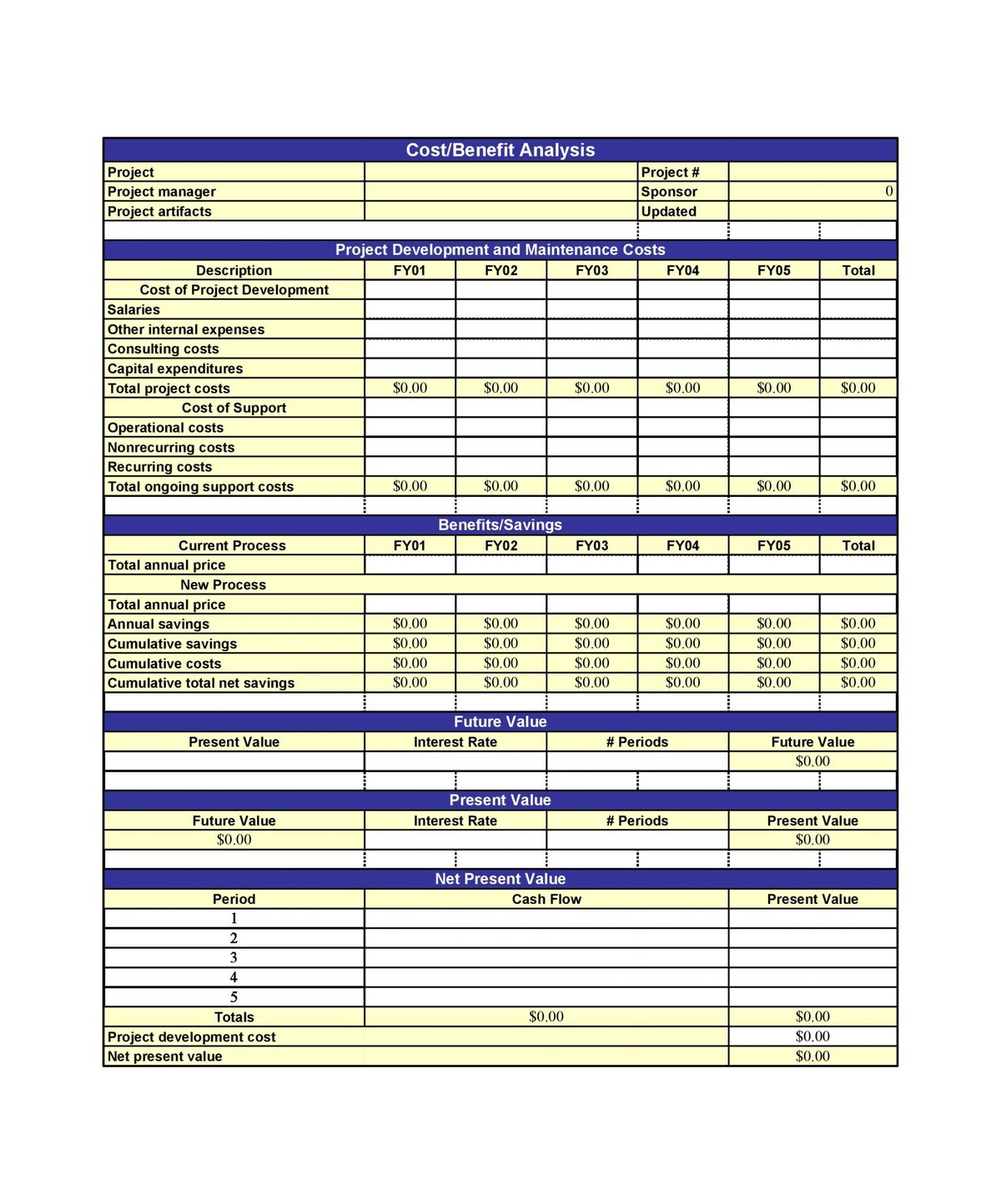

Effective templates typically include sections for:

- Clearly defining the project scope and objectives.

- Detailed lists of direct, indirect, opportunity, and intangible costs.

- Comprehensive lists of direct, indirect, and intangible benefits.

- Spaces for assigning monetary values, with clear documentation of assumptions.

- Calculations for Present Value (PV), Net Present Value (NPV), and the CBA ratio.

- Sections for performing sensitivity analysis.

- A summary area for presenting results, limitations, and recommendations.

Who Benefits Most?

CBA templates are widely used across various sectors:

- Businesses: To evaluate new product lines, technology upgrades, or market expansions.

- Governments: For assessing infrastructure projects, policy proposals, or public service programs.

- Non-profit Organizations: To weigh the impact and feasibility of new initiatives against their mission.

- Project Managers: To justify project proposals and continuously monitor their financial health.

Taking the Leap: Your Next Steps

You now have a solid understanding of how a comprehensive Pricing, Plans & Cost-Benefit Breakdown works and why it's indispensable for smart financial decision-making. The real value, however, comes from putting this knowledge into practice.

Start small. Apply a simplified CBA framework to a decision you're currently facing, whether professional or personal. Identify the key costs and benefits, make your best estimates, and observe how the structured approach clarifies your options. Look for existing CBA templates online or within your organization to streamline your first attempt.

Remember, the goal isn't perfect precision from day one, but rather a systematic way of thinking. By embracing Cost-Benefit Analysis, you're not just crunching numbers; you're building a foundation for more confident, successful, and strategically sound choices in every aspect of your financial journey.